Cryptocurrency, a field that’s exploded to a whopping $2 trillion in total market capitalization, has traders and investors scrambling to find the most effective analysis methods. The two most prominent schools of thought, technical analysis and fundamental analysis, offer unique perspectives. Both methodologies are hotly debated, each boasting fervent advocates and staunch critics. This article dissects both approaches, examining their respective merits and downsides to help investors and traders identify the strategy best suited to their needs.

The Art and Science of Technical Analysis in Crypto Trading

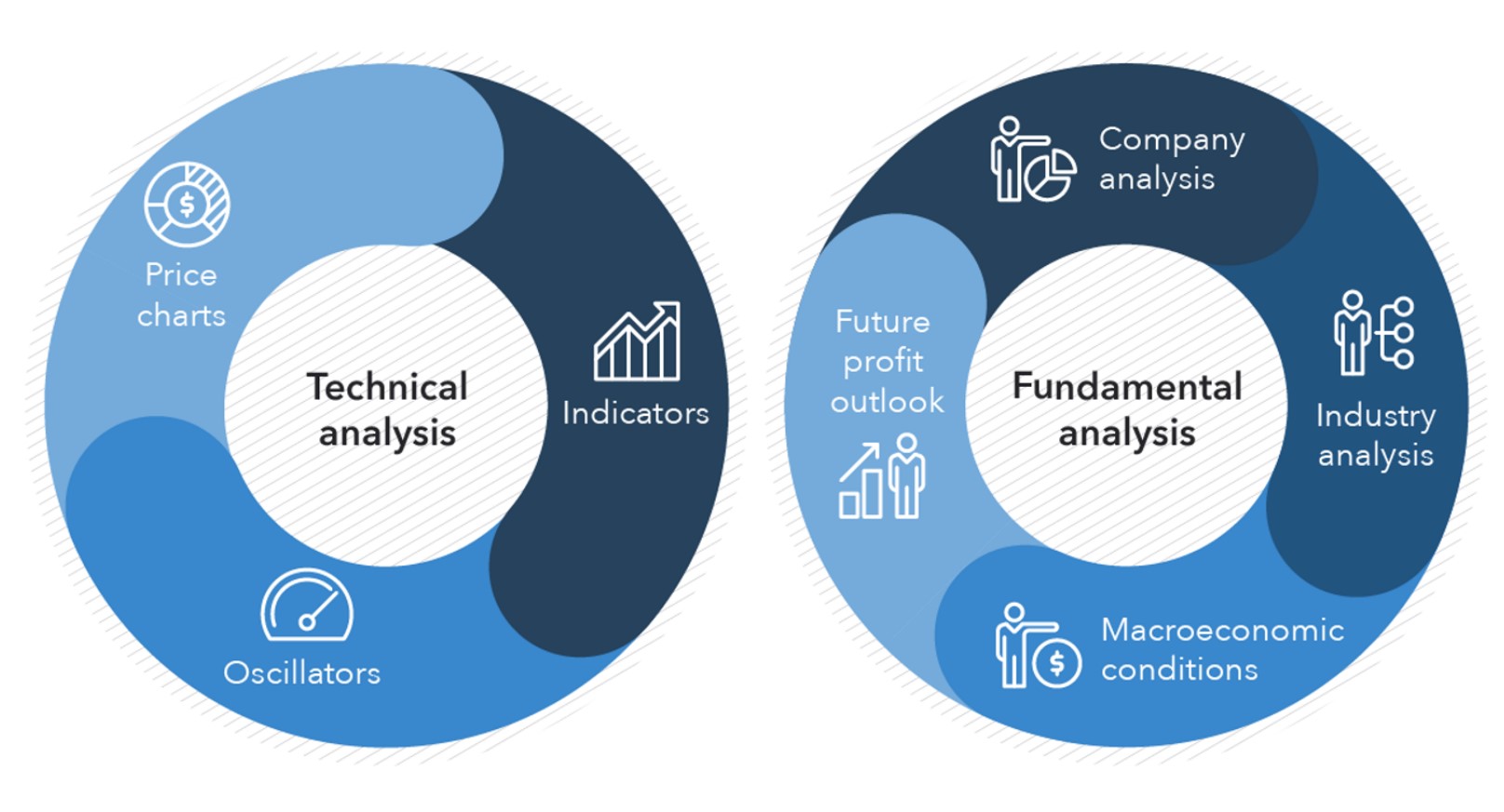

Technical analysis is an analytical method used to evaluate financial assets, including cryptocurrencies, by dissecting historical price data to forecast future price trends. The process assumes that history tends to repeat itself, and thus, past price patterns can illuminate profitable trading opportunities. Tools such as moving averages, trend lines, and candlestick patterns are commonly used in this form of analysis [1].

[1] Investopedia. (2021). Technical Analysis. Retrieved from https://www.investopedia.com/terms/t/technicalanalysis.asp

The Strengths and Shortcomings of Technical Analysis

For the rapid-fire world of crypto trading, technical analysis offers certain clear advantages. Firstly, it delivers actionable signals, providing traders with precise entry and exit points based on historical price patterns. This can be particularly beneficial for day traders and short-term investors looking to leverage quick price fluctuations.

Additionally, technical analysis is versatile, adaptable to a variety of time frames. This flexibility empowers traders to customize strategies in line with their risk tolerance, investment objectives, and resources.

Finally, the volatile nature of cryptocurrency markets, characterized by abrupt price changes, makes technical analysis an especially valuable tool. It aids traders in identifying trends and price reversals, enabling them to react swiftly and adapt their strategies to sudden market shifts.

However, the method isn’t without its limitations. Technical analysis is largely indifferent to the underlying fundamentals of a cryptocurrency, such as its technology, use case, or team. Consequently, it may overlook an asset’s long-term potential or inherent risks.

Moreover, critics point out that technical analysis can become a self-fulfilling prophecy. When a large cohort of traders rely on the same signals, prices can move in the anticipated direction, which could potentially overemphasize short-term trends at the expense of long-term patterns and fundamentals.

The Deep Dive of Fundamental Analysis in Crypto Trading

Contrasting technical analysis, fundamental analysis evaluates financial assets by exploring their intrinsic value. It takes into account a myriad of factors such as technology, competition, and market adoption. For cryptocurrency trading, this means assessing elements like the project’s team, technology, use case, token economics, and market potential [2].

[2] Investopedia. (2021). Fundamental Analysis. Retrieved from https://www.investopedia.com/terms/f/fundamentalanalysis.asp

The Benefits and Drawbacks of Fundamental Analysis

Fundamental analysis offers a long-term perspective, allowing investors to identify projects with robust fundamentals and growth prospects. This approach is particularly advantageous for long-term investors aiming to assemble a portfolio of high-quality assets with the potential for appreciation over time.

Further, it considers a broad spectrum of factors that could impact a cryptocurrency’s value, providing investors with a comprehensive understanding of an asset’s potential risks and rewards.

Fundamental analysis also tends to be less influenced by short-term market fluctuations and noise, as it zeroes in on the intrinsic value of a cryptocurrency. This helps investors maintain a long-term perspective and resist being swayed by short-term price movements.

However, fundamental analysis isn’t a walk in the park. It requires thorough research into a wide array of factors, which can be time-consuming and complex. This might not be suitable for all investors, especially those constrained by time or resources.

The subjectivity involved in interpreting qualitative factors, like the competence of a project’s team or potential regulatory impacts, can introduce bias and lead to differing conclusions among investors. Additionally, as it doesn’t provide specific entry and exit points based on short-term price movements, fundamental analysis may be less useful for short-term traders.

In Conclusion

Cryptocurrency trading can be navigated using both technical and fundamental analysis, each with its own strengths and weaknesses. Technical analysis offers actionable signals and is highly adaptive to volatile markets, making it a favored choice for short-term traders. Meanwhile, fundamental analysis provides a long-term perspective and a holistic understanding of an asset’s potential, making it ideal for long-term investors.

The best strategy, however, is likely to depend on an individual’s investment objectives, risk tolerance, and available resources. Some traders may find it advantageous to blend elements of both technical and fundamental analysis into their strategies. This hybrid approach allows them to seize short-term opportunities while keeping an eye on long-term potential.

Thus, in the wild west of cryptocurrency trading, it’s not about finding the one-size-fits-all best approach—it’s about finding the best approach for you. Whether you’re a day trader or a long-term investor, understanding the nuances of both technical and fundamental analysis can arm you with the insights needed to navigate this exciting yet volatile landscape.

FAQs

TA (Technical Analysis) focuses on price charts and patterns, while FA (Fundamental Analysis) digs into the underlying factors, like project fundamentals and market sentiment. It’s charts vs. project health, essentially!

Not necessarily. Some traders swear by TA, while others are FA diehards. Most pros mix ’em up for a holistic view. It’s all about what vibes with your trading style.

Totally! While TA is often seen in the day-trading realm, longer-term indicators like the MACD or Bollinger Bands can give insights into future market moves.

Look at whitepapers, team quality, partnerships, adoption rates, and tokenomics. The “health” of a project is key. Always DYOR (Do Your Own Research) before diving in!

You bet! Sentiment analysis gauges the mood of the market, often using social media buzz or news. In the crypto world, we sometimes call this “the crypto Twitter vibe check.”

TA usually offers quicker signals with its charts and patterns, perfect for those scalping or day trading. FA can be a deeper dive, but its results might give you stronger conviction.

Check out platforms like TradingView or Coinigy. They’re packed with indicators, from RSI to Fibonacci retracements, to feed your charting obsession.

Many traders use FA for altcoins, especially when trying to uncover the next hidden gem. But remember, with great rewards come great risks. Keep those risk management hats on!

It happens to the best of us. Mix and match both TA and FA, but don’t overdo it. Sometimes, you gotta trust your gut and take the leap.

Whales can manipulate price (affecting TA) but also spread news or FUD (affecting FA). Both realms are susceptible to these big fish moves.

While many TA tools are universal, some indicators like the NVT Ratio are more crypto-centric. Always good to spice things up with some crypto flair!

Both have their intricacies. TA might be visually overwhelming at first, and FA requires a keen eye for detail. But hey, we’ve all started somewhere. Dive in and enjoy the ride!